As stated in an earlier post, banks use some kind of point system to classify and determine whether or not you can be a good borrower.

Banks understand that there are risks to giving a loan out to borrowers so they have a system to help decrease these types of lending risks.

To make it easier for them to classify potential low risk borrowers, banks will use a point system. Note that each bank will have their own unique system but I can assure you that the point system described here will be very similar to what banks use. Here are 7 criteria you should have that banks look at.

Contents

A Bank Account

Having a bank account early in your life will benefit you and help you get some points. If you do not have a bank account yet, create a bank account as early as you can. Just having a checkings or savings account with money inside is good enough. Bank accounts are very easy to make and a minimum deposits can be at least $20. Also, making consistent monthly deposits to your bank account will help you earn points! (Note: if you’re really tight on money, borrow money from a relative to make a bank account. Once the account is made, take out that money the next day and give it back to your relative. You will still have a bank account but with no money in it. Just make sure to put some money in it when you finally get some income.)

Credit References

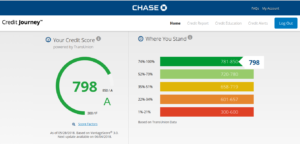

Use your credit card on transactions for necessary things (i.e. food, gas, car loans, school tuition) can serve as solid references. Use your credit card at least once a month at the grocery stores and gas stands and then make sure to pay them off every month. This is how you can slowly build your credit standing and increase the amount in your credit line. The better credit standing you have, the more bank points you can earn. This is the kind of score everyone should strive for!

Dependents

Do you have any kids? Any dependents? Having kids or dependents make you a low flight-risk. Some banks will give you points just for having dependents.

Earnings

The more the better. Just make sure you have a stable source of income that actually goes into your bank account. Making deposits to your bank account builds a financial track record for you and the bank.

Employment

Low skilled jobs such as waiters and cab drivers would considerably have less bank points compared to someone with a high-skilled profession such as a doctor, lawyer, college professor, and etc. High-skilled professions usually score the most bank points. So if we were using a scale of 1 to 10, doctors would get 10 points while waiters would score 1. In some way, it does pay to study hard in school and learn a technical profession not everyone can do. I like to add that for someone who just started a business, he may not really earn that much bank points.

Employment Duration

The more years you have at your job, the better. A friend of mine who works as a loan officer says you’re all good if you worked at your job for at least 3 years. Anything less may not be good enough. Depends on type of job you have and the bank. Some banks for example classify secure jobs such as a civil servants (teachers, cops, firefighters, and etc.) a safe investment. The reason to this is stability. Jobs within the government are considered more stable compared to jobs in the private sector. People who work in the private sector can easily lose their job if the company not doing well financially compared to a government job.

There are always exceptions. For example, lets say you quit your job and move to a different company but with a related profession; you will not lose points compared to quitting your job and doing something totally different from what you were doing. It all depends on the bank. Check with your loan officer.

Marital Status

It’s sad truth but yes, it’s best to be married or widowed compared to being divorced or single (at least when it comes to building credit). The reason is simple. Being married shows stability and banks love stability. This will sound harsh but I know a lot of people (aka gold-diggers) who marry just to get better credit standing. It’s not surprising that most are not happy with their lives. The ultimate lesson I learned from those that married for money is that love is not about money. There is more to life than just money. When money gets in the pictures, some people can forget what marriage is supposed to be about. Marriage is about being with someone you love until death do you part. Marry someone because you want to be with them forever and not because you want to have better credit or some points to get a loan.

Bank Points are not Perfect

Again, no system is perfect and the banks point system for classifying individuals if they are low risk borrowers is not always dependable. For example, a close friend of mine is a very successful self-employed man who started his small design firm with nothing. He made it big after working 18 hours a day for three years. Because his business is internet-based, he never really cared about having a permanent residence. He is single, travels abroad a lot, has probably around 100K in the bank, and definitely enjoying every minute of his life. However, he did have some difficulty securing a loan to purchase land compared to a friend who just graduated from the fire academy, who has a wife that is expecting their first child. My firefighter friend secured a home loan like it was almost nothing. How funny is life. Remember that no system is perfect.